How to Calculate Incremental Working Capital in Excel: Step-by-Step Formula Guide

Incremental working capital is the additional working capital required to support the growth of a business. It is the difference in working capital between two periods of time, typically the current period and the next period. Calculating incremental working capital is important for businesses because it provides insight into the additional funds needed to support growth and for lenders, it provides information about the ability of a business to repay a loan. We’ll show you how to calculate incremental working capital in Excel.

Table of Contents

Working capital table

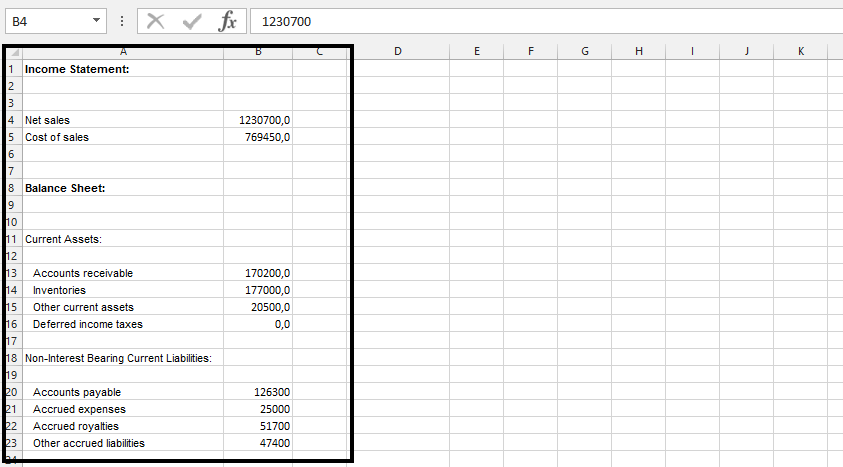

The first step in calculating incremental working capital is to set up the data in Excel. You’ll need to enter the current and future period working capital data into two separate columns. The working capital data should include the following items:

- Current Assets: short-term assets that can be converted into cash within a year.

- Current Liabilities: short-term liabilities that must be paid within a year.

- Future Assets: estimated future value of current assets.

- Future Liabilities: estimated future value of current liabilities.

Just make the Working Capital Table, which looks like this:

To properly calculate working capital requirements, click on a cell beside Required Cash and multiply cell B4 by 0.02 to compute the needed cash amount.

Click beside account receivable (on the working capital table), and type the same value in the income statement.

Note: Repeat this step for inventory and other current assets.

Net Working Capital calculations

Click beside current operating assets and type =SUM(B3:B6), to calculate it.

Note: Repeat step three for accounts payable, accrued expenses, royalties, and other accrued liabilities (put the same value that is in the income statement in Working Capital), and use step four to calculate other operating liabilities = SUM (E9:E12).

To calculate net working capital efficiently, click beside the Net Working Capital cell and enter the formula =E7-E13 to compute the difference.

Note: Under this step, you should put the result on the net networking capital.

The final step is to calculate the incremental working capital, which is the difference between the current working capital and the previous working capital. The formula for incremental working capital is:

=Current Working Capital – Previous Working Capital

Click beside the incremental working capital and minus the networking capital of the year from the previous one.

Click beside the sales, and put the same value beside the net sales.

Click beside sales increment (1), and minus this year’s sales from the previous one (2).

Click beside incremental working capital, then divide incremental working capital with the incremental sales.

Note: You can now change the format to percentage. By right-clicking on the result, choosing format cells, then choosing percentage.

The result of the incremental working capital calculation will give you an estimate of the additional funds needed to support growth. A positive result means that the business will require additional working capital to support growth, while a negative result means that the business will have excess working capital.

Leave a Reply