How to Calculate ROCE in Excel: Return on Capital Employed – Complete Step by Step Guide

In this comprehensive lesson, you will learn how to calculate ROCE in Excel using the return on capital employed formula and understand how to measure business efficiency and profitability.

What does ROCE stand for?

ROCE (Return on Invested Capital) stands for return on capital employed and represents one of the most essential profitability measures in business finance. ROCE is a powerful profitability metric used to evaluate how efficiently a company generates returns from its invested capital in Excel, regardless of asset structure or external factors. The return of capital employed should be higher than the weighted average cost of capital.

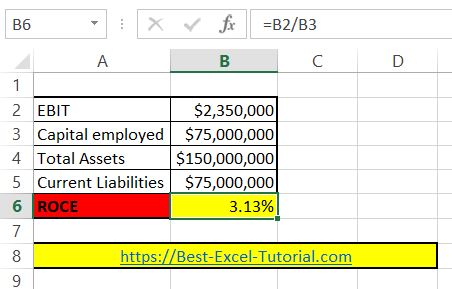

Let’s build the return on capital employed calculator in Excel. To calculate ROCE in Excel, you will need two key pieces of financial data: Earnings Before Interest and Taxes (EBIT) and Capital Employed. Typically, you can find these figures in a company’s financial statements.

ROCE calculator

Copy and paste this roce formula in cell B4: =B2/B3

This formula will calculate the ROCE for data you place in cells B2 and C2 and is based on ROCE equation formula:

ROCE = EBIT / Capital Employed

Alternatively, here’s another formula to calculate ROCE in Excel:

ROCE = EBIT / (Total Assets – Current Liabilities)

To format ROCE as a percentage in Excel, select cell B4, then press CTRL + 1 to open the Format Cells dialog, and choose Percentage with 2 decimal places.

ROCE is expressed as a percentage, so a high ROCE indicates that a company is generating a high return on its capital investments, while a low ROCE indicates that a company is not generating enough return to cover its cost of capital.

It’s important to note that ROCE is just one of many financial metrics used to evaluate a company’s financial performance. Other metrics, such as return on equity (ROE) and return on assets (ROA), can provide a more complete picture of a company’s financial health. It’s also important to consider the context of the industry in which the company operates, as well as the company’s historical performance, when evaluating ROCE.

Downloand a free sample spreadsheet here.

By mastering how to calculate ROCE in Excel, you’ll gain valuable insights into your company’s financial performance and make more informed investment and business decisions based on accurate return on capital employed analysis.

Leave a Reply