How to Calculate WACC in Excel

WACC, which stands for Weighted Average Cost of Capital, is the way a company can measure how much its capital costs. The WACC indicator is expressed as a percentage and is most often used to assess the attractiveness of an investment.

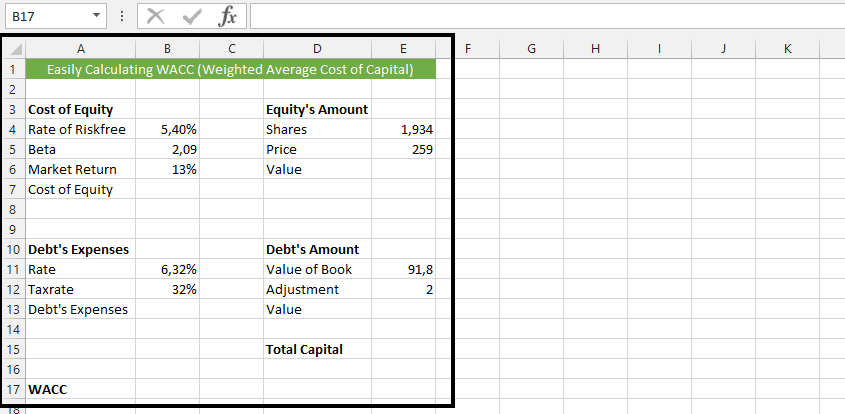

It is crucial to have some kind of data before calculating the Weighted Average Cost of Capital.

Data preparation

List the various sources of capital for the company, such as equity, debt, preferred stock, etc. This data would looks something like this:

Wacc calculations

To calculate the cost of equity, click on B7 (1), type =B4+B5*(B6-B4) (2), and press enter.

If the result is a number, use the format cell to convert it to a percentage.

Click on the cell beside the debt’s expenses (1), and type in =B11*(1-B12) (2), and then press enter.

Click on the cell beside Value (1), and type =E4*E5 (2), to calculate the value on Equity’s amount.

Click on beside the value under the debt’s amount (1), and type in =E11*E12, and then enter.

Click beside Total capital (1) and type in =E6+E13 (2).

Click the cell next to WACC (1), enter =B7*E6/E15+B13*E13/E15, and press enter.

This is how to calculate WACC in Excel. The formula for WACC in Excel is: = SUMPRODUCT(Cost * Weight) / SUM(Weight). You can use this as well.

It’s crucial to use market values rather than book values for the capital components when calculating WACC. Market values reflect the current market perception of the company’s equity and debt, providing a more accurate representation of the company’s cost of capital.

Leave a Reply