How to Create a Declining Balance Depreciation in Excel

A declining balance is a method of calculating the depreciation of an asset over time using accelerated depreciation techniques, where the depreciation rate remains constant, but the amount of depreciation decreases each period. In this Excel lesson on declining balance depreciation, you will learn how to calculate and implement Declining Balance Depreciation using Excel formulas.

Table of Contents

Understanding Declining Balance Depreciation

The declining balance method is a type of accelerated depreciation technique, which means that it calculates a higher amount of depreciation in the early years of an asset’s life, and a lower amount of depreciation in the later years. This declining balance depreciation method is used to more accurately reflect the declining economic value of the asset over time.

To use the declining balance method in Excel, you need to have the original cost of the asset and the expected useful life of the asset. From there, you can calculate the depreciation rate, which is the rate at which the asset is depreciating over time.

Data preparation

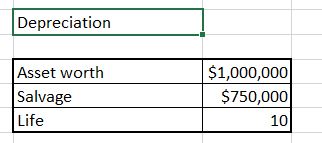

We are having data about an asset in your balance sheet.

The asset:

- it is 1 million of dollars worth

- salvage value is $750 000

- life of the asset is 10 years

To calculate a reducing balance we will use DB Excel formula.

Formula syntax

Syntax of Declining Balance Excel formula is:

- cost

- salvage

- life

- period

Luckily, we already have all data we need.

Declining Balance Calculations

To calculate yearly depreciation use =DB($C$4,$C$5,$C$6,C9) formula.

Absolute reference is needed because the data will not change in the table. Only the last arguments changes because it is the value of the year.

Cumulative depreciation is just =C11+D10. Drag it right to calculate all of them. This is just a current year value plus sum of previous ones.

Deprecated value is =$C$4-C11 which is the starting value reduced by cumulative depreciation.

This is Declining Balance formula and the easiest way to calculate Declining Balance Depreciation in Excel.

You can download the spreadsheet from my GitHub account.

The difference between straight line depreciation and declining balance is that for straight line depreciation yearly depreciation is the same value and for declining balance it is different (based on percentage).

Leave a Reply